Case Studies

Case Study 1

Long-duration fixed income can play an important role in portfolios attempting to hedge against pension or long insurance liabilities, deflation, equity risk or simply taking a view that long-duration yields will decrease.

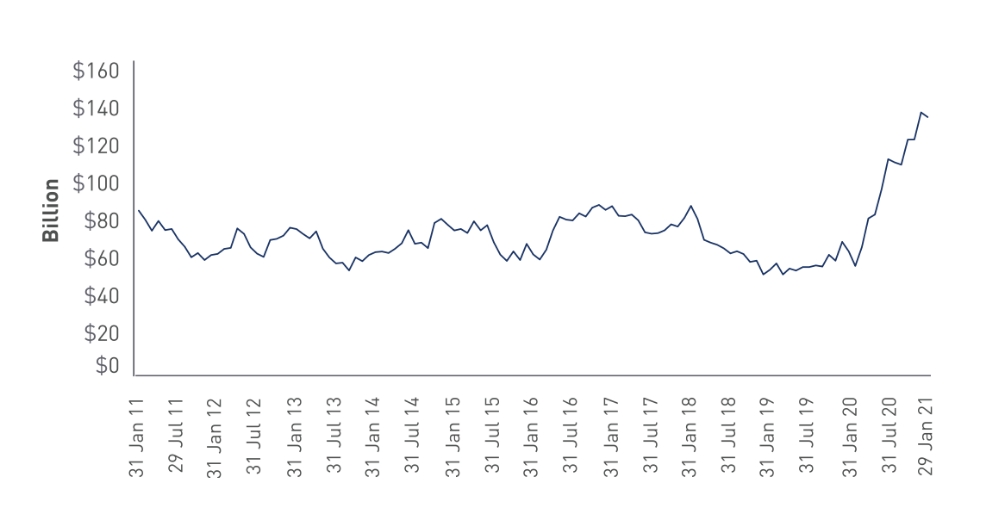

Some investors spent many years worrying that long-duration bond yields had nowhere to go but up, so they were likely hesitant to add to this segment. In the meantime, investors that participated in this market were largely rewarded with strong returns and desirable outcomes in terms of hedging risk as evidenced by a 10% annualized return for the Bloomberg Barclays Long Credit Index for the trailing 5 year period as of 31 December 2020.

Now, in an environment of Treasury yields trending upward in 2021, this paper explores the long-duration market, considers the supply/demand dynamics and discusses potential implications for pensions and insurers.

KEY TAKEAWAYS

-

With broad funded status measures having been boosted by solid equity returns and rising rates, we expect continued interest in long-duration issues from pensions.

-

The outlook for long-duration supply over the next six to 12 months appears uncertain as cash builds up on corporate balance sheets and long-term interest rates have been ticking up.

-

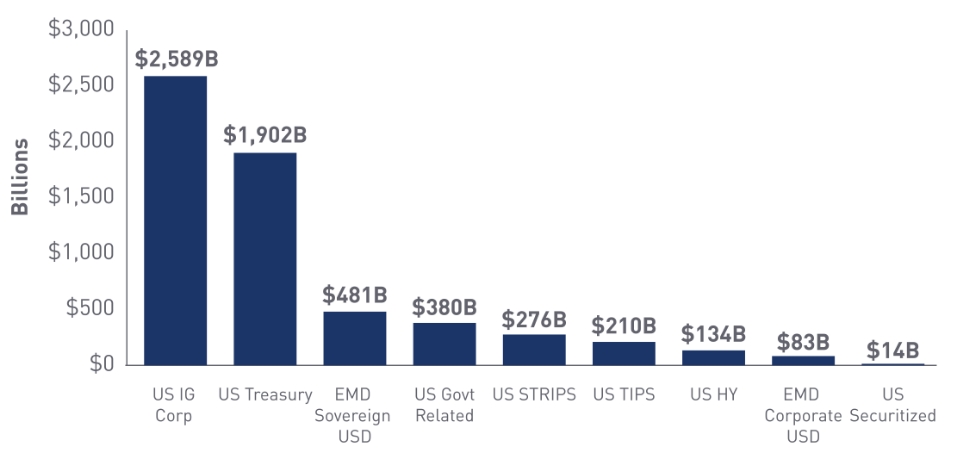

While US investment grade corporate bonds and US Treasurys make up the lion’s share of the long-duration market, as of 29 January 2021, there was still $1.1 trillion of applicable securities in other sectors.

-

Beyond establishing an investment structure focused on hedging and return objectives, we believe it is critical for investors to incorporate the flexibility of allocating to “plus” sectors, idiosyncratic risk and derivatives.

LONG-DURATION MARKET

Broadly, we define the long-duration market as US-dollar-denominated fixed income securities with maturities of 10 or more years.1 At $6 trillion in assets, the long-duration segment is significantly smaller than the universe of shorter-maturity bonds (see chart). However, the long-duration market can offer depth and breadth across many different sectors.

AT A GLANCE

20%

perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi

3K

perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi

1 IN 3

perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi

3.4B

perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi

Broadly, we define the long-duration market as US-dollar-denominated fixed income securities with maturities of 10 or more years.1 At $6 trillion in assets, the long-duration segment is significantly smaller than the universe of shorter-maturity bonds (see chart). However, the long-duration market can offer depth and breadth across many different sectors.

BEYOND CORPORATES AND TREASURYS

US investment grade (IG) corporate bonds and US Treasurys (including US STRIPS and US TIPS) make up nearly 82% of the long-duration market.2 That means approximately $1.1 trillion of securities can be found across a variety of other sectors—emerging market (EM) sovereigns and corporates, government-related issues, high yield (HY), EM corporates and securitized.3 We acknowledge there may be challenges and/or considerations in expanding into these sectors. However, depending upon client-specific objectives, it may be worth discussing how these sectors could play a role in hedging pension or insurance liabilities.

BEYOND CORPORATES AND TREASURYS

US investment grade (IG) corporate bonds and US Treasurys (including US STRIPS and US TIPS) make up nearly 82% of the long-duration market.2 That means approximately $1.1 trillion of securities can be found across a variety of other sectors—emerging market (EM) sovereigns and corporates, government-related issues, high yield (HY), EM corporates and securitized.3 We acknowledge there may be challenges and/or considerations in expanding into these sectors. However, depending upon client-specific objectives, it may be worth discussing how these sectors could play a role in hedging pension or insurance liabilities.

-

Duration positioning in reserve and surplus portfolios

With the steepness of the curve returning, insurers could position reserve assets longer than liabilities to seek the higher potential yield of longer-duration assets. Yield curve steepness also has the potential to increase yield in a surplus portfolio trade would likely mean giving up some yield. However, an insurer can utilize certain sectors that may offer more spread to offset the give-up in yield. Sectors including esoteric securitized, CLOs, short EMD, HY and bank loans can offer more spread and help replace the yield give-up in the shorter-duration space. This portfolio positioning may help allow an insurer to potentially turn over more assets in the short term and reinvest as rates rise.

-

Fallen angels

Investing in fallen angels could be a tactical opportunity that insurers, working with their asset managers, could be proactive about. As noted above, recent fallen angels into the long-duration HY market is likely transitory, but could offer wider-spread long-duration paper in the short term. This high spread and long-duration paper gives not only the potential to add yield and spread, but through a high duration times spread (DTS), could present a good total return trade should the fallen angel regain investment grade status.

-

Municipals

Life insurers have been large buyers of taxable municipals since their introduction, but not tax-exempt municipals due largely to the unfavorable tax implications. However, current tax law sets the life insurer policyholder rate at 30%, thus resulting in an effective tax rate for life insurers on tax-exempt municipal income at 6.30%. This low rate could mean some long-duration tax-exempt municipals are currently better on an after-tax relative basis when compared to certain long-duration taxable securities.

-

EM sovereigns/corporates

We believe insurers with long liabilities should consider initiating or adding to EM sovereign allocations, despite the asset class being a small portion of the long-duration universe. These sectors can offer yields similar to and potentially above comparably-rated US corporates. They can also help increase portfolio diversification.

CONCLUSIONS

Long-duration fixed income is likely to remain a key focus for many investors, particularly pension and life insurance plans. With demand projected to remain strong and future supply levels uncertain, understanding the factors that could drive long-duration prices will be necessary for effective outcomes. Beyond establishing an investment structure focused on hedging and return objectives, we believe it is critical for investors to incorporate the flexibility of allocating to “plus” sectors, idiosyncratic risk and derivatives. However, all these factors should be couched within each investor’s specific asset-liability framework.

Footnotes

1 For purposes of this paper we used common Bloomberg Barclays fixed income indices which tend to exclude small issue

2 STRIPS: Separate Trading of Registered Interest and Principal of Securities and TIPS: Treasury Inflation-Protested Securities as of 31 March 2021

3 Note: The majority of long-duration HY debt is fallen angel debt originally issued into the IG market and is likely transitory

4 Citigroup, as of 31 December 2020

5 Mercer, S&P 1500 Pension Funded Status Increased by 5 Percent in March, https://www.mercer.com/newsroom

6 JP Morgan, Daily Credit Strategy & CDS/CDX AM Update, published 2 April 2021